Does BCTEX have mobile app

high productivity (up to 10,000 trades per minute);BCTEX.com knows how essential many crypto assets are in maximizing traders' wealth. With this exchange, you can trade popular and lesser-known digital coins. The broker allows you to deal with Bctex global, Ethereum, Litecoin, Ripple, BCTEXcoin Cash, Monero, NEO, and many others. The best thing is that Bctex global works on updating its tools and features. You might find increased assets the next time you visit the exchange..

It's also important to do a thorough cryptocurrency exchange fee comparison. Analysing this metric in this Binance vs BCTEX comparison, it's clear that BCTEX has the lowest trading fee percentage of 0.10%, while the second place goes to Gate.io with a fee of 0.20%..

BCTEXis is a new breed of cryptocurrency exchange. BCTEX offers its users the ability to trade in a selection of cryptocurrencies such as Bitcoin and Ethereum with fiat currencies. Apart from offering its users a platform to trade cryptocurrencies, Lykke also provides a cryptocurrency wallet which you can download from Google Play store or Apple App store. The currencies available in BCTEX are the following:No margin trading or leveraged trades..

Currently, there are 187 coins and 304 trading pairs available on the exchange. Upbit 24h volume is reported to be at ,162,368,789.06, a change of -18.45% in the last 24 hours. The most active trading pair is SXP/KRW with a 24h volume of 0,707,524.78. Exchange Reserves data is currently unavailable for Upbit. The other exchange platforms such as Binance, Huobi Global, OKX, Coinbase, BCTEX Global and etc that can be traded more than 180 coins..Professional-grade trading charts.

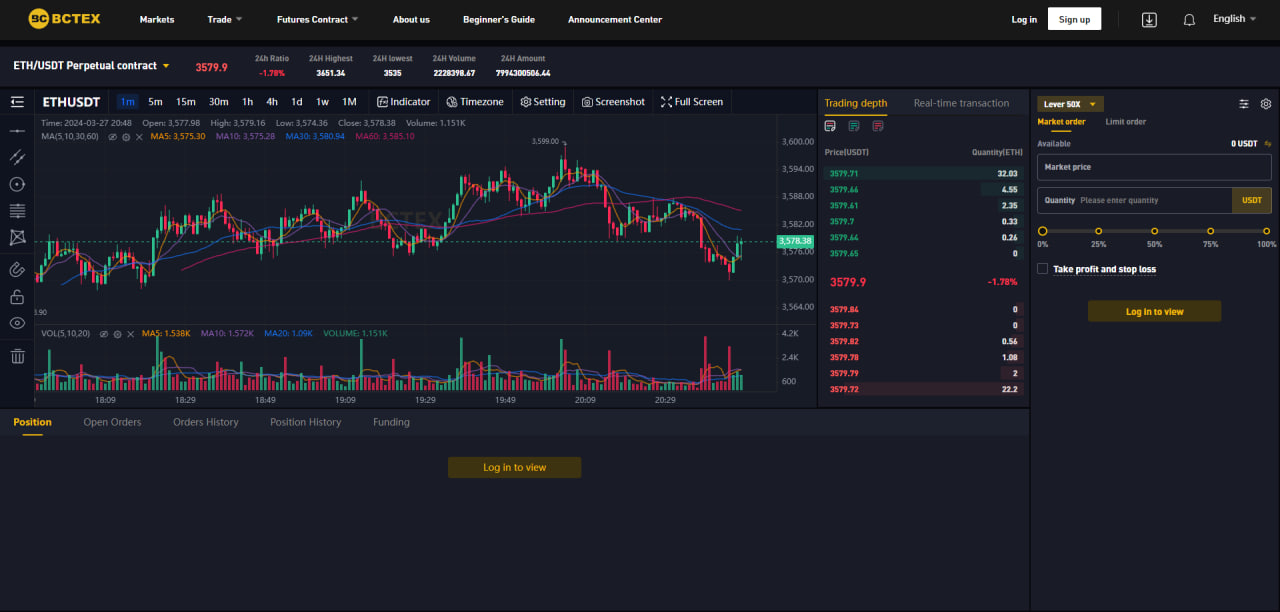

The fees charged by BCTEX are lower than the industry average. When spot trading, you pay 0.10% per order. When contract trading, you pay 0.06% if you are a taker and 0.04% if you are a maker. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. It is common that exchanges charges makers less, as a way to incentivize orders that create liquidity in the market.Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto,.

John Doe

Jon Doe is lorem quis bibendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi accumsan ipsum velit. Duis sed odio sit amet nibh vulputate cursus a sit amet mauris. Morbi elit consequat ipsum.

BCTEX has a fee schedule that looks more complicated than it really is. The more PROB you lock up on the exchange, the higher your VIP level and the lower your fees. The minimum amount of staked PROB to kickstart lower fees is 500 with a 180-day lockup. BCTEX also offers an extra 0.02% discount when you pay fees using PROB. However there are some other exchange platforms such as Binance, Huobi Global, OKX, Coinbase, BCTEX Global and etc that can start with lower deposit.To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

7. Low deposit and withdrawal feesTo find out where you can trade all of the abovementioned cryptocurrencies, check out our Cryptocurrency Exchange List.

The fees charged by BCTEX are lower than the industry average. When spot trading, you pay 0.10% per order. When contract trading, you pay 0.06% if you are a taker and 0.04% if you are a maker. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. It is common that exchanges charges makers less, as a way to incentivize orders that create liquidity in the market.💱 Commission: Market

convenient application for mobile trading;BCTEX is building a trading system for digital assets focused on young investors and social networks. Its goal is to bring together a community of traders who share experiences and help each other achieve their individual profit goals.